Case Study 105: Due Diligence Essentials: Acquiring a 20-Unit Apartment in Dallas

- nuelmarketing999

- Oct 17, 2025

- 1 min read

For developers eyeing opportunities in a thriving market like Dallas, securing a multi-family apartment building demands meticulous due diligence. This case study outlines the critical requirements and considerations for purchasing a 20-unit complex, ensuring a sound investment and successful acquisition financing.

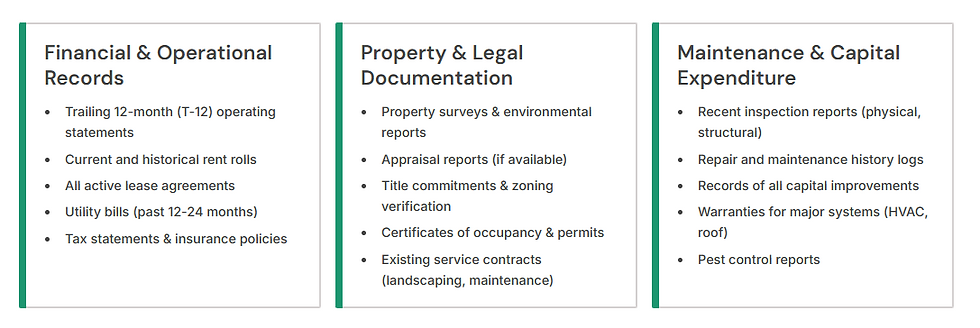

Comprehensive Document Checklist

A thorough review of these documents is foundational to understanding the property's value, operational health, and potential risks.

Typical Due Diligence Timeline

A typical acquisition process involves several critical phases, each with specific milestones to ensure a smooth transaction.

Key Considerations for Multi-Family Acquisition Financing

Securing optimal financing requires understanding the factors lenders prioritize in the Dallas market.

Navigating these due diligence and financing complexities with an experienced partner like NextGen can streamline your acquisition process, ensuring you secure the best terms for your investment in Dallas.

Comments